The fraction’s numerator is the number of months (including parts of a month) in the tax year. You cannot use the MACRS percentage tables to determine depreciation for a short tax year. A short tax year is any tax year with less than 12 full months. This section discusses the rules for determining the depreciation deduction for property you place in service or dispose of in a short tax year. It also discusses the rules for determining depreciation when you have a short tax year during the recovery period (other than the year the property is placed in service or disposed of). In January, you bought and placed in service a building for $100,000 that is nonresidential real property with a recovery period of 39 years.

AccountingTools

As explained earlier under Which Depreciation System (GDS or ADS) Applies, you can elect to use ADS even though your property may come under GDS. ADS uses the straight line cafeteria plans grow in popularity method of depreciation over fixed ADS recovery periods. Most ADS recovery periods are listed in Appendix B, or see the table under Recovery Periods Under ADS, earlier.

Inclusion Amount Worksheet for Leased Listed Property

- One of the machines cost $8,200 and the rest cost a total of $1,800.

- Usually, a percentage showing how much an item of property, such as an automobile, is used for business and investment purposes.

- To determine your depreciation deduction for 2023, first figure the deduction for the full year.

- You figure the depreciation rate under the SL method by dividing 1 by 5, the number of years in the recovery period.

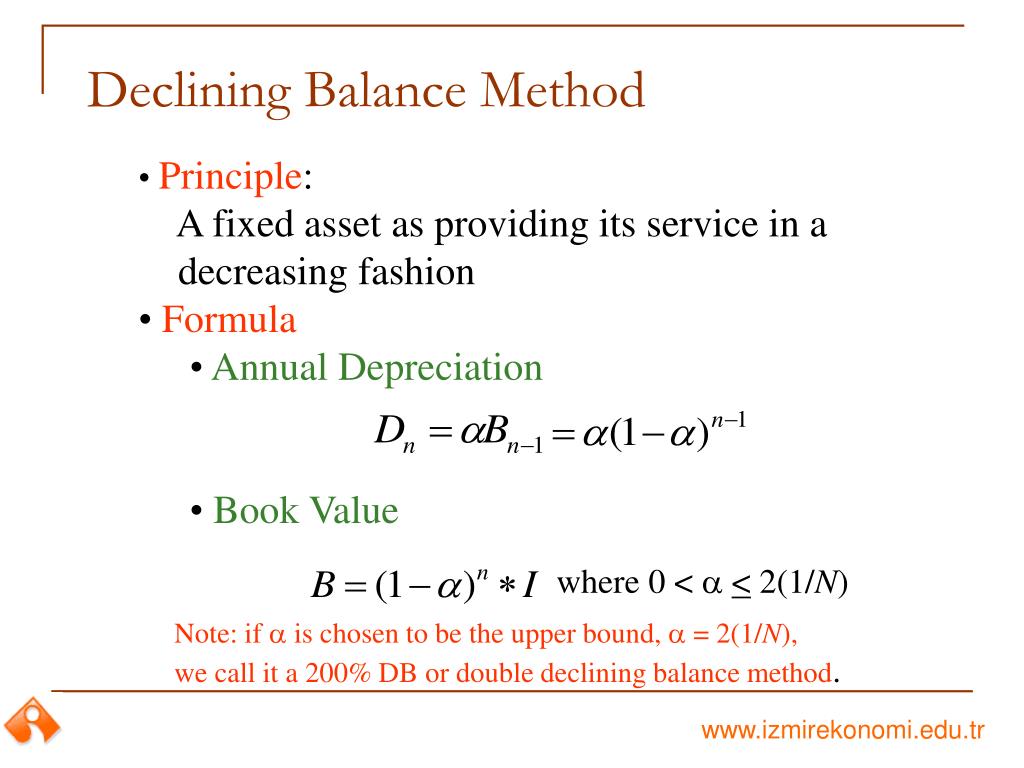

- The reason for this is that the rate of depreciation (20% in this case) is being applied to the book value, which continually reduces each year.

An asset costing $20,000 has estimated useful life of 5 years and salvage value of $4,500. Calculate the depreciation for the first year of its life using double declining balance method. While the straight-line depreciation method is straight-forward and most popular, there are instances in which it is not the most appropriate method. Assets are usually more productive when they are new, and their productivity declines gradually due to wear and tear and technological obsolescence. Thus, in the early years of their useful life, assets generate more revenues. For true and fair presentation of financial statements, matching principle requires us to match expenses with revenues.

Related AccountingTools Courses

They figure that amount by subtracting the 2022 MACRS depreciation of $536 and the casualty loss of $3,000 from the unadjusted basis of $15,000. They must now figure their depreciation for 2023 without using the percentage tables. To help you figure your deduction under MACRS, the IRS has established percentage tables that incorporate the applicable convention and depreciation method. These percentage tables are in Appendix A near the end of this publication. You begin to claim depreciation when your property is placed in service for either use in a trade or business or the production of income.

Depreciation of Long-Term Assets

You also use the item of listed property 40% of the time in your part-time consumer research business. Your item of listed property is listed property because it is not used at a regular business establishment. You do not use the item of listed property predominantly for qualified business use.

Get in Touch With a Financial Advisor

You also made an election under section 168(k)(7) not to deduct the special depreciation allowance for 7-year property placed in service last year. Because you did not place any property in service in the last 3 months of your tax year, you used the half-year convention. You figured your deduction using the percentages in Table A-1 for 7-year property.

To include as income on your return an amount allowed or allowable as a deduction in a prior year. A capitalized amount is not deductible as a current expense and must be included in the basis of property. The total of all money received plus the fair market value of all property or services received from a sale or exchange. The amount realized also includes any liabilities assumed by the buyer and any liabilities to which the property transferred is subject, such as real estate taxes or a mortgage. A ratable deduction for the cost of intangible property over its useful life. The original cost of property, plus certain additions and improvements, minus certain deductions such as depreciation allowed or allowable and casualty losses.

You must determine whether you are related to another person at the time you acquire the property. You generally cannot use MACRS for real property (section 1250 property) in any of the following situations. You must use the Modified Accelerated Cost Recovery System (MACRS) to depreciate most property.